To maintain the lights on, we obtain affiliate commissions by way of a few of our hyperlinks. Our overview course of.

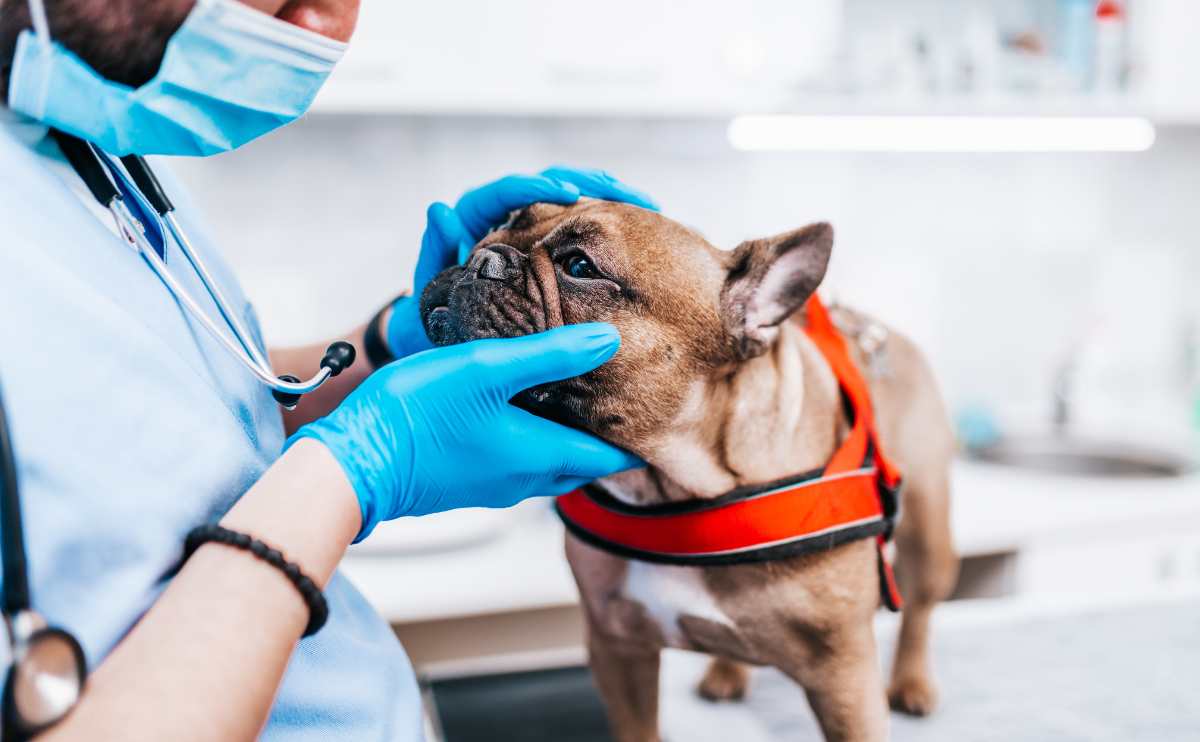

French Bulldogs are the preferred canine breed within the U.S. Excessive demand means excessive price, and a few pet dad and mom spend a number of thousand {dollars} to buy a Frenchie. Should you’re spending that sort of cash to have the breed be a part of your loved ones, you need to think about insuring the canine to assist them dwell as comfortable and wholesome as doable.

As pet insurance coverage specialists, we’ll assist you choose the perfect pet insurance coverage to your French Bulldog and level out any potential saving alternatives for you. Let’s dig into our Frenchie insurance coverage information to see why we predict Pets Finest, Fetch, Wholesome Paws, Embrace, Figo, Lemonade, and Trupanion are among the many greatest.

Finest Pet Insurance coverage For French Bulldogs

Our specialists researched the perfect pet insurance coverage for French Bulldogs based mostly on frequent family wants. We selected the perfect pet insurers for Frenchies based mostly on the canine’s age, premium value, protection, particular well being circumstances, and extra that can assist you discover the perfect coverage to your canine.

Finest Customizable Plans: Pets Finest

- Deductible Choices: $50, $100, $200, $250, $500, $1,000

- Annual Payout Choices: $5,000, Limitless

- Reimbursement Choices: 70%, 80%, 90%

In-Depth Evaluation Of Pets Finest

Why We Picked Pets Finest

Pets Finest gives a number of coverage sorts, together with Accident-only, Important (accident and sickness protection), Plus (Important plan with examination payment protection), and Elite (Plus plan with rehab, acupuncture, and chiropractic protection). It additionally gives a number of deductible, reimbursement, and annual payout choices to assist customise your plan to fit your needs and your Frenchie’s wants. With so many choices, discovering a plan from Pets Finest that matches your price range and protection wants is straightforward.

Skilled Value Evaluation

Pets Finest premiums sometimes fall on the decrease to center vary of the pricing spectrum. Pricing actually different based mostly on Frenchie’s age and placement. So, a quote to your French Bulldog might be among the many lowest or fall extra in the course of the pack.

| Professionals | Cons |

|---|---|

| Customise your plan to suit your price range and desires with completely different deductible, reimbursement, and payout choices | Longer than common declare processing averages (7-14 days) |

| Might have possibility for Pets Finest to pay your vet on to keep away from ready for reimbursement | Excludes different/holistic therapies and C-sections |

| Accident-only plan accessible | |

| Non-compulsory wellness plans accessible as an add-on | |

| Shorter than common ready intervals (3 days for accidents and 14 days for hip dysplasia) | |

| Persistently among the many lowest costs |

Finest For Puppies: Fetch

- Deductible Choices: $300, $500, $700

- Annual Payout Choices: $5,000, $10,000, $15,000

- Reimbursement Choices: 70%, 80%, 90%

In-Depth Evaluation Of Fetch

Why We Picked Fetch

Fetch begins enrolling puppies as younger as six weeks previous, one of many earliest within the trade. Different insurers require pets to be a minimum of eight weeks previous at enrollment. One distinctive characteristic Fetch gives is as much as $1,000 for digital vet visits. Fetch is an excellent pet insurance coverage possibility for that brand-new Frenchie you carry dwelling.

Skilled Value Evaluation

Fetch was constantly among the many least costly insurers when utilizing the identical deductible, reimbursement, and annual payout for younger Frenchies.

| Professionals | Cons |

|---|---|

| Customise your plan to suit your price range and desires with completely different deductible, reimbursement, and payout choices | Cannot have Fetch pay your vet on to keep away from ready for reimbursement |

| Behavioral therapies, different/holistic therapies, C-sections, sick go to examination charges, and gum illness are included in protection | No accident-only plan accessible |

| Non-compulsory wellness plans accessible as an add-on | Longer than common accident ready interval (15 days) |

Finest For Limitless Payouts: Wholesome Paws

- Deductible Choices: $100, $250, $500, $750, $1,000

- Annual Payout Choices: Limitless

- Reimbursement Choices: 50%, 60%, 70%, 80%, 90%

In-Depth Evaluation Of Wholesome Paws

Why We Picked Wholesome Paws

Wholesome Paws has limitless annual payouts in all its insurance policies. When evaluating Wholesome Paws towards different insurers with the identical deductible, reimbursement, and limitless payouts, Wholesome Paws is commonly extra reasonably priced. Frenchies are predisposed to many pricey well being circumstances, and with limitless annual payouts to your coverage, you don’t have to fret about hitting a restrict. Wholesome Paws insurance policies are fantastic for pet dad and mom who need peace of thoughts they gained’t hit an annual cap on their protection.

Skilled Value Evaluation

Wholesome Paws fees extra for male French Bulldogs than females (the everyday distinction is lower than $10/month). I additionally observed Wholesome Paws has many coverage protection restrictions for Frenchies. For instance, a 5-year-old Frenchie residing in Buffalo, NY, wasn’t insurable by means of Wholesome Paws. Lastly, many different Frenchie pet insurance coverage quotes had no customizations accessible (sometimes restricted to 70% reimbursement with a $500 deductible).

| Professionals | Cons |

|---|---|

| Might have possibility for Wholesome Paws to pay your vet straight and keep away from ready for reimbursement | Restricted customization choices based mostly in your pet’s age |

| Shorter than common CCL surgical procedure ready interval (15 days) | No accident-only plan accessible |

| Shorter than common declare processing (2 days) | Not enrolling pets older than 14 years previous |

| Limitless payouts for all plans | Excludes behavioral therapies, different/holistic therapies, C-sections, examination charges, and gum illness |

| Longer hip dysplasia ready intervals than common (12 months) and pets enrolled after age 6 are ineligible for hip dysplasia protection (MD does not have this age limitation) | |

| Longer than common accident ready interval (15 days) |

Most In depth Protection: Embrace

- Deductible Choices: $100, $250, $500, $750, $1,000

- Annual Payout Choices: $5,000, $8,000, $10,000, $15,000, Limitless

- Reimbursement Choices: 70%, 80%, 90%

In-Depth Evaluation Of Embrace

Why We Picked Embrace

Embrace’s accident and sickness insurance policies are among the many most complete, with the fewest exclusions. Insurance policies embrace $1,000 for dental sickness protection yearly, one thing that’s more likely to get used with Frenchie’s predisposition to overcrowding of enamel, resulting in an infection and tooth decay. Embrace additionally consists of protection referring to examination charges, behavioral remedy, and different/holistic remedy in all plans. In the meantime, different firms could require an add-on for this sort of protection. Embrace is a wonderful insurer for fogeys wanting nose-to-tail protection for his or her Frenchie.

Skilled Value Evaluation

For one of many many French Bulldog quotes I ran, Embrace supplied no protection. The quote was for a 5-year-old Frenchie residing in San Diego, CA. With Frenchies being the preferred breed and California being the state with essentially the most insured pets and gross written premiums within the U.S., I anticipated there can be protection choices for a pet with these specs.

| Professionals | Cons |

|---|---|

| Customise your plan to suit your price range and desires with completely different deductible, reimbursement, and payout choices | Restricted to accident-only protection in the event you enroll your canine after their fifteenth birthday |

| Might have possibility for Embrace to pay your vet on to keep away from ready for reimbursement | C-sections are excluded |

| Non-compulsory wellness plans accessible as add-on | |

| Shorter than common accident ready interval (2 days) and declare processing (5 days) | |

| Behavioral therapies, different/holistic therapies, examination charges, gum illness, and tooth extractions are included |

Finest Worth: Figo

- Deductible Choices: $100, $250, $500, $750

- Annual Payout Choices: $5,000, $10,000, Limitless

- Reimbursement Choices: 70%, 80%, 90%, 100%

In-Depth Evaluation Of Figo

Why We Picked Figo

Figo gives in depth protection with decrease pricing. It additionally has glorious customer support and averages three days for declare processing. Plans are customizable, and you’ll add certainly one of two wellness plans. Situations which are usually excluded are included in Figo’s protection (e.g., behavioral therapies, different/holistic therapies, and C-sections). With aggressive pricing and complete protection, Figo is a wonderful possibility for Frenchie dad and mom.

Skilled Value Evaluation

Figo’s lowest protection plan ($750 deductible, 70% reimbursement, $5,000 annual payout) constantly resulted within the lowest value for Frenchies in comparison with different insurers. Moreover, Figo fees extra for males than females, typically $20 extra monthly for males in comparison with a feminine Frenchie.

| Professionals | Cons |

|---|---|

| Customise your plan to suit your price range and desires with completely different deductible, reimbursement, and payout choices | Cannot have Figo pay your vet on to keep away from ready for reimbursement |

| Non-compulsory wellness plans accessible as an add-on | No accident-only plan accessible |

| Shorter than common accident ready interval (1 day) | |

| Persistently among the many lowest costs | |

| Shorter than common declare processing (3 days) | |

| Behavioral therapies, different/holistic therapies, and C-sections are included in protection | |

| Diminishing deductible for annually a policyholder is declare free, lowering by $50 till it’s $0 |

Most Inexpensive: Lemonade

- Deductible Choices: $100, $250, $500

- Annual Payout Choices: $5,000, $10,000, $20,000, $50,000, $100,000

- Reimbursement Choices: 70%, 80%, 90%

In-Depth Evaluation Of Lemonade

Why We Picked Lemonade

A number of components are essential in selecting a pet insurance coverage supplier, however pricing is commonly a number one deciding issue, particularly for Frenchies, as a result of the breed might be costlier. For French Bulldogs, Lemonade is commonly one of the crucial reasonably priced insurers, making it a great place to begin your search if value is your main concern. Lemonade has solely been promoting pet insurance coverage since 2020, and well being circumstances which are included in different insurers’ fundamental insurance policies are extra charges by means of Lemonade. Nevertheless, in the event you’re okay with skipping out on protection for some circumstances to pay a decrease premium and the product’s newness doesn’t hassle you, then Lemonade could also be a great match to your Frenchie.

Skilled Value Evaluation

Lemonade constantly had among the lowest pet insurance coverage costs for French Bulldogs when utilizing the identical deductible, annual payout, and reimbursement.

| Professionals | Cons |

|---|---|

| Customise your plan to suit your price range and desires with completely different deductible, reimbursement, and payout choices | Cannot have Lemonade pay your vet on to keep away from ready for reimbursement |

| Non-compulsory wellness plans accessible as an add-on | No accident-only plan accessible |

| Shorter than common ready intervals (2 days for accidents and 14 days for hip dysplasia) | Solely accessible in 37 states and Washington DC |

| Shorter than common declare processing (2 days) | Breed restrictions based mostly on age |

| Behavioral therapies, different/holistic therapies, examination charges, and gum illness protection can be found for an additional payment |

Lemonade Pet Insurance coverage Is Solely Accessible In: AL, AZ, AR, CA, CO, CT, FL, GA, IL, IN, IA, MD, MA, MI, MS, MO, MT, NE, NV, NH, NJ, NM, NY, NC, ND, OH, OK, OR, PA, RI, SC, TN, TX, UT, VA, WA, WI, District of Columbia

Finest For Bilateral Situations: Trupanion

- Deductible Choices: $0 – $1,000 (in $5 increments)

- Annual Payout Choices: Limitless

- Reimbursement Choices: 90%

In-Depth Evaluation Of Trupanion

Why We Picked Trupanion

Trupanion’s insurance policies have no bilateral exclusions (any situation or illness that might have an effect on either side of the physique). Examples of bilateral circumstances embrace hip dysplasia and patella luxation, which French Bulldogs are predisposed to. Many pet insurance coverage suppliers have bilateral exclusions, so, for instance, in case your Frenchie is recognized with hip dysplasia on the left aspect, then it is going to be excluded on the best aspect. Bilateral circumstances might be very pricey, so having protection for these can prevent important cash, making Trupanion a worthy consideration.

Skilled Value Evaluation

Trupanion was one of many few insurers that charged completely different quantities for female and male French Bulldogs. Typically, males price extra, and different instances, females price extra. Moreover, Trupanion had the highest premiums for Frenchies by far, typically costing a whole lot of {dollars} greater than different pet insurers.

| Professionals | Cons |

|---|---|

| 90% reimbursement with limitless payouts for all plans | No accident-only plan accessible |

| Might have possibility for Trupanion to pay your vet on to keep away from ready for reimbursement | Pets older than 14 are ineligible for enrollment |

| Shorter than common CCL surgical procedure and hip dysplasia ready intervals (30 days) | Longer than common sickness ready interval (30 days) |

| Shorter than common declare processing averages (2 days) | Persistently among the many most costly |

| Behavioral therapies, C-sections, and tooth extractions are included in protection | Examination charges are excluded |

What Kind Of Pet Insurance coverage Plan Is Finest For French Bulldogs?

There are two kinds of pet insurance policy: accident-only and accident and sickness. Some insurers supply elective wellness plans for an additional payment, however these usually are not insurance coverage merchandise. Nevertheless, as a result of insurers supply wellness plans throughout enrollment, we embrace them right here to tell you of your choices to your Frenchie.

What Are Accident-Solely Pet Insurance coverage Plans?

Accident-only plans cowl the price of emergencies because of accidents and accidents. Examples embrace damaged bones, chunk wounds, cranial cruciate ligament tears, eye trauma, and extra. These are true emergency-only plans, however not all insurance coverage firms supply them.

Pricing Tip – Accident-only plans are sometimes extra reasonably priced than accident and sickness plans as a result of they don’t cowl diseases.

What Are Accident & Sickness Pet Insurance coverage Plans?

Accident and sickness plans are the most typical pet insurance coverage plan. They cowl accidents, resembling international physique ingestion, poisoning, and different emergencies listed within the accident-only plans, and disease-related circumstances, resembling allergy symptoms, ear infections, diarrhea, brachycephalic syndrome, and extra. These insurance policies are extra complete than accident-only plans.

What Are Wellness Plans?

Wellness insurance policies are bought as add-ons or standalone merchandise and have month-to-month or annual premiums. Preventative-related objects are included on this protection, resembling annual exams, vaccinations, dental cleanings, spay/neuter procedures, and extra. Wellness plans allow you to price range for routine procedures to assist keep your French Bulldog’s well being and stop diseases. French Bulldog dad and mom who go for wellness protection are sometimes extra proactive with their Frenchie’s well being as a result of they reap the benefits of extra preventative objects.

Wellness plans usually are not pet insurance coverage and don’t help with prices associated to accidents or diseases.

What Does Pet Insurance coverage Cowl & Exclude?

Pet insurance coverage protection varies based mostly on the coverage kind and the corporate you select. Most accident and sickness pet insurance policy cowl the next objects when deemed medically obligatory. Nevertheless, this protection could have limitations, so please test your coverage.

| Lined | Excluded |

|---|---|

| Blood exams | Boarding |

| Most cancers (chemo & radiation) | Cremation & burial prices |

| CAT scans | Elective procedures (e.g., declawing, ear cropping, spaying/neutering, tail docking, and so forth.) |

| Continual circumstances | Meals & dietary supplements |

| Congenital circumstances | Grooming |

| Emergency care | Pre-existing circumstances* |

| Euthanasia | Being pregnant & breeding |

| Hereditary circumstances | Vaccines |

| MRIs | |

| Non-routine dental remedy | |

| Prescription drugs | |

| Rehabilitation | |

| Specialised exams & care | |

| Surgical procedure & hospitalization | |

| Ultrasounds | |

| X-rays |

What Determines The Price Of Pet Insurance coverage For French Bulldogs?

Pet insurance coverage pricing is predicated on many issues, together with your French Bulldog’s particulars (e.g., age, breed, location). Typically talking:

- Youthful Frenchies are much less more likely to expertise an accident or sickness, leading to older French Bulldogs being costlier than younger Frenchie pups to insure

- Purebreds (like French Bulldogs) incur extra well being issues than blended breeds, leading to purebreds being costlier than blended breeds to insure

- Males require increased doses of medicine, bigger medical tools, and extra medical provides than females as a result of they’re bigger, leading to males being costlier than females to insure

- The price of provides, workplace area, workers, and so forth., straight correlate to the price of vet care, so if the price of residing is excessive in your space, then likelihood is your pet insurance coverage premium and vet payments will likely be increased, too

The objects above are much less adjustable as a result of you’ll be able to’t change the age of your French Bulldog, whether or not they’re male or feminine, or the place you reside (effectively, you’ll be able to change the place you reside, however the price of your pet insurance coverage premium most definitely gained’t be the only choice issue). Nevertheless, your plan is inside your management and might enable you extra management over what you spend in your French Bulldog’s pet insurance coverage plan.

Plan Particulars & Protection Matter

Whether or not you select an accident-only or accident and sickness pet insurance coverage coverage will affect your premium. The utmost payout, deductible, and reimbursement share additionally affect your pet insurance coverage premium.

Study Extra

What Is The Most Payout & Why Does It Matter?

There are two kinds of payouts: annual and lifelong. An annual payout is the utmost quantity the insurance coverage firm will reimburse throughout the coverage interval. A lifetime payout is the best quantity the insurer will reimburse over the pet’s insured lifetime. Most pet insurers have annual payouts, which the commonest are $5,000, $10,000, and limitless.

Pricing Tip – Most payout is one thing you’ll need to think about fastidiously as a result of decrease payouts will decrease your premium but in addition means you’re accountable for extra bills in case your Frenchie has costly vet remedy.

Is The Deductible Annual Or Per-Incident?

The deductible is essential as a result of it’s the portion of the vet invoice you’re accountable for paying earlier than the insurance coverage firm reimburses you. The commonest deductibles are $100, $250, and $500.

An annual deductible requires you to pay the deductible as soon as per coverage time period. A coverage with an annual deductible might be simpler to price range for as a result of you already know you’ll solely want to fulfill the deductible as soon as throughout the 12 months. Most pet insurance coverage firms have annual deductibles.

A per-incident deductible requires you to pay the deductible as soon as for every new emergency your pet encounters. A coverage with a per-incident deductible might be costlier in case your Frenchie is recognized with many circumstances. Nevertheless, in case your French Bulldog is recognized with a power situation, you’ll solely pay the deductible for that situation as soon as over the Frenchie’s insured lifetime.

Pricing Tip – A coverage with a better deductible usually leads to a decrease month-to-month premium.

What’s The Reimbursement Share?

The reimbursement share is the sum of money the insurance coverage firm covers after your deductible is met. The commonest reimbursement percentages are 70%, 80%, and 90%. The remaining share is your copay, so in the event you select an 80% reimbursement, you’ll be accountable for 20% after the deductible is met.

Pricing Tip – Selecting a decrease reimbursement share leads to a decrease premium.

How A lot Is Pet Insurance coverage For A French Bulldog?

In accordance with NAPHIA (North American Pet Well being Insurance coverage Affiliation), the typical month-to-month premium for an accident and sickness canine insurance coverage coverage within the U.S. is $53.34 ($32.25 for cats).

Beneath is a pet insurance coverage value comparability to present you an concept of what a coverage may price to your French Bulldog. Listed are among the greatest pet insurance coverage firms and their month-to-month premiums for every pattern Frenchie.

* 70% reimbursement

† 50% reimbursement and $1,000 deductible (no different choices)

‡ $0 deductible

§ Limitless annual payouts

French Bulldog Insurance coverage Price: Lowest & Highest Quantities

We gathered the bottom and highest month-to-month prices for French Bulldog pet insurance coverage from every insurer beneath. We included two completely different ages to assist present how prices can range based mostly on once you join Frenchie insurance coverage.

| Firm | 2mo previous 92121 (San Diego, CA) | 5yr previous 92121 (San Diego, CA) | 2mo previous 14211 (Buffalo, NY) | 5yr previous 14211 (Buffalo, NY) | 2mo previous 33604 (Tampa, FL) | 5yr previous 33604 (Tampa, FL) | 2mo previous 78703 (Austin, TX) | 5yr previous 78703 (Austin, TX) | 2mo previous 07108 (Newark, NJ) | 5yr previous 07108 (Newark, NJ) |

|---|---|---|---|---|---|---|---|---|---|---|

| $42-$261 | $56-$352 | $24-$152 | $32-$205 | $20-$143 | $27-$192 | $36-$207 | $45-$255 | $24-$156 | $33-$211 |

| $46-$119 | $98-$259 | $44-$100 | $83-$192 | $51-$117 | $94-$219 | $54-$121 | $97-$224 | $50-$113 | $91-$210 |

| $55-$82 | $80-$121 | $59* | Uninsurable | $64-$134 | $113-$243 | $89* | $130* | $67* | $98* |

| $33-$203 | Uninsurable | $32-$193 | $32-$197 | $31-$113 | $41-$148 | $41-$148 | $54-$194 | $41-$148 | $45-$161 |

| $39-$180 | $51-$234 | $34-$214 | $44-$278 | $11-$144 | $15-$187 | $13-$167 | $17-$208 | $20-$211 | $26-$274 |

| $40-$194 | $62-$262 | $29-$99 | $40-$134 | $25-$141 | $34-$190 | $43-$129 | $30-$100 | $33-$111 | $87-$381 |

| $112-$496 | $199-$898 | $79-$345 | $138-$619 | $129-$239 | $234-$434 | $62-$266 | $121-$540 | $87-$381 | $180-$811 |

States chosen have been based mostly on the highest 5 states to have essentially the most insured pets and highest gross written premiums for pet insurance coverage, based on NAPHIA. The cities chosen have been based mostly on essentially the most pet-friendly cities in the preferred states above, based on WalletHub.

How Does Pet Insurance coverage For French Bulldogs Work?

Pet insurance coverage helps cowl the price of vet remedy for the insured Frenchie’s situation. Earlier than protection kicks in, you’ll want the ready intervals to be over. Then, your reimbursement will depend on your plan’s most payout, deductible, and reimbursement share (which we clarify extra beneath). Fortuitously, utilizing pet insurance coverage is tremendous easy.

- Take your French Bulldog to the vet and pay the invoice on the time of service.

- Submit a accomplished declare type and an itemized receipt to your insurance coverage firm. Some firms require a signature out of your vet, so it’s smart to take a printed copy of your declare type to your go to.

- As soon as the declare is accredited, the insurance coverage firm will ship your reimbursement* by way of your chosen fee methodology (test, direct deposit, and so forth.).

*The reimbursement timeline can range from a couple of minutes to a couple weeks, relying on the complexity of your declare and the promised processing time. The reimbursement quantity will depend on your coverage particulars, together with deductible, annual payout, reimbursement share, protection, and exclusions.

What Are Ready Intervals For French Bulldog Pet Insurance coverage?

Ready intervals are the time between enrollment and when your Frenchie’s protection kicks in. Every pet insurance coverage supplier’s ready intervals differ, however the commonest ready intervals are for accidents (sometimes 0 to fifteen days) and diseases (sometimes 14 days). Nevertheless, some firms require extra ready intervals (as much as one 12 months) for orthopedic circumstances like cranial cruciate ligaments and hip dysplasia (each of which French Bulldogs are predisposed to).

*Ready intervals for California, Maine, and Mississippi are as follows:

- Accidents – 0 days

- Diseases – 14 days

- Cruciate Ligament Situations – 30 days

- Routine Care – 0 days

What Are Frequent Well being Points For French Bulldogs?

Beneath are among the mostly recognized well being points for Frenchies. We’ve categorized the well being points, however some circumstances fall into a number of classes. Relying on the trigger and the way your vet diagnoses a situation will decide what class it falls into.

Is Pet Insurance coverage Value It For French Bulldogs?

The Royal Veterinary Faculty discovered that 72.4% of French Bulldogs underneath vet care in 2013 had a minimum of one well being difficulty documented. Moreover, in 2013, French Bulldogs have been the eleventh hottest canine breed, based on AKC. Frenchies have risen in reputation, topping the charts because the #1 hottest canine breed in 2022. The breed’s rising reputation can solely imply extra of our beloved pups would require medical care.

Sadly, French Bulldogs are predisposed to numerous breed-specific well being points, so pet insurance coverage is important for the breed. Should you spend the cash on a purebred Frenchie, insurance coverage can assist them dwell their longest, healthiest life.

5 Steps To Discover The Finest Pet Insurance coverage For French Bulldogs

When procuring round for the perfect pet insurance coverage for Frenchies, keep in mind that a French Bulldog’s life expectancy is 10 to 12 years. You’ll need to select proper the primary time. Listed below are some issues to bear in mind to search out the perfect plan to your pooch (you might need to seize a notepad to make an inventory).

- Study concerning the insurance coverage firms’ reputations. Firms with years of expertise are extra secure than brand-new insurers.

- Take into account the well being points Frenchies are predisposed to and know the phrases related to protection for these circumstances.

- Determine if you would like accident-only or accident and sickness protection.

- Understand how declare reimbursement happens and the typical processing time.

- Get pet insurance coverage quotes from a minimum of three firms to match pricing.

Methodology

To find out the perfect pet insurance coverage for French Bulldogs, we analyzed greater than 40 pet U.S. insurance coverage firms to supply an unbiased breakdown of how suppliers evaluate towards each other. Our in-depth analysis consists of:

- operating hundreds of value quotes

- studying a whole lot of buyer evaluations

- scrutinizing each coverage from high to backside and studying all of the tremendous print

- scoping out the acquisition course of

- talking with customer support representatives

- having firsthand expertise submitting claims with firms

- evaluating plan customization particulars

- analyzing how lengthy it takes to obtain reimbursement

- factoring in firm historical past and years within the pet insurance coverage market

- assembly with firm representatives to debate adjustments associated to the trade, their firm, and their choices

- requiring nationwide expertise for firms

In contrast to many different overview websites, we refuse to let pet insurance coverage firms pay for the highest spot in our rankings. Firms should earn their place in our comparisons by performing effectively within the market. We additionally level out every firm’s professionals and cons in mild of their competitor’s strengths. In doing so for over a decade, we’ve helped pet dad and mom make extra educated selections among the many high pet insurance coverage choices. Pet insurance coverage suppliers learn our evaluations, recurrently test them for accuracy, and worth our enter to assist create constructive trade adjustments and higher defend your pets. We solely advocate the perfect of the perfect as a result of it’s what our readers deserve.